A proposed electricity tariff hike by the Northern Regional Electricity Distributor (NORED) has sparked frustration among Rundu residents, who have strongly opposed the suggested 3% increase for the 2025/2026 financial year.

During a recent public consultation, community members expressed concern that the proposed increment is unjustified given the ongoing economic hardship and high unemployment rate in the region. “We are already struggling,” said one resident. “A hundred dollars now gives us just 38 units how much less will we get if this goes through?”

Beyond the issue of affordability, residents also raised complaints about NORED’s service delivery, citing poor customer support and a visible lack of infrastructure maintenance in many areas.

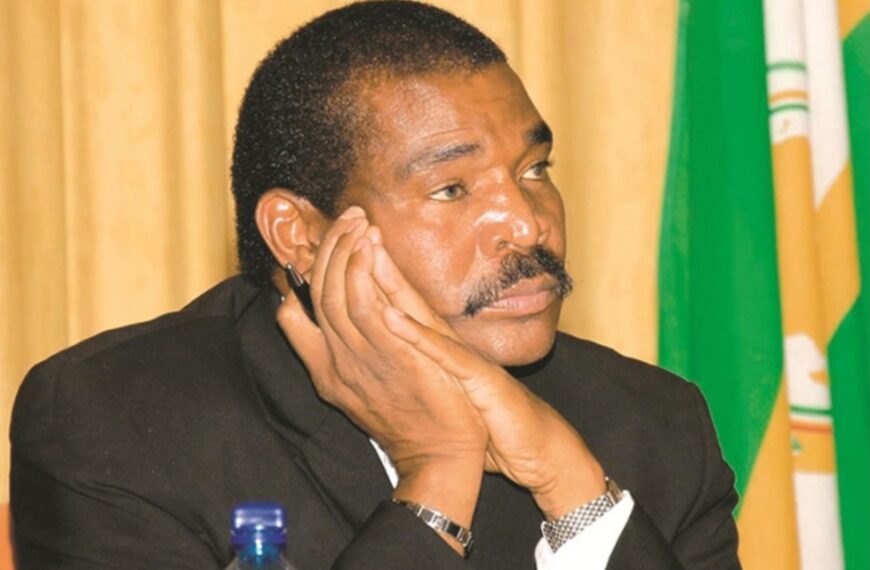

Responding to the concerns, NORED’s Acting Chief Executive Officer, Toivo Shovaleka, explained that the tariff adjustment request is primarily driven by external pressures. These include a 3.8% bulk electricity price increase granted to NamPower and the rising cost of rural electrification efforts.

Shovaleka also revealed that NORED has budgeted for a 12% increase in safety, health, and environmental costs, stating that safety has become a top priority after recurring incidents over the past three years. “We are rolling out a safety campaign to educate both our customers and employees. Our aim is to reach a zero-harm objective,” he said.

On the state of infrastructure, he admitted that maintaining the network and operating an ageing fleet continues to be a challenge. Even if the Electricity Control Board (ECB) approves the 3% increase, Shovaleka said the utility would still face financial strain in meeting operational demands.

Pinehas Mutota, Executive for Economic and Market Regulation at the ECB, reaffirmed the importance of such public hearings. “These engagements are crucial. They ensure that the tariff-setting process remains transparent, inclusive, and based on the real experiences of the people affected,” he stated.

The final decision on NORED’s application is still pending review by the ECB.